The IRS has just released important details about EITC refunds for the 2023-2024 tax year. If you’re wondering what EITC is all about, it stands for Earned Income Tax Credit – a fantastic opportunity for eligible individuals and families to receive a substantial refund. This blog post is your go-to guide for understanding the ins and outs of EITC refunds. We’ll cover eligibility criteria, how to claim your refund, and why it’s crucial to act now. Don’t miss out on the chance to maximize your tax benefits – it’s time to unlock the potential of EITC refunds!

EITC Refunds-Overview

| Category | Details |

| update | EITC Refunds |

| Year | 2024 |

| Month | February 28 |

| COUNTRY | USA |

| Administering Agency | US Federal Government, Provincial Government |

| Oversight Authority | Internal Revenue Service |

| Goal | to provide a significant refund boost to millions of low- to moderate-income workers and their families |

| Eligible Recipients | Citizens over the age of 65 years |

| Expected Date of Payment | February 28, 2024 |

| Payment Amount Range | $632 to $7,830 |

| Method of Payment | Direct bank account deposits |

| For official details visit | irs.gov |

What are EITC Refunds?

The IRS determines taxes by considering income, family size, and filing status.

The duration of tax refunds varies based on the chosen refund method and the credited amount.

This article delves into the details of EITC Refunds, specifically Earned Income Tax Credits designed for US taxpayers.

EITC is a refundable tax aimed at reducing the tax owed, providing a credit that surpasses the liability for a given tax year.

also, visit :

Not Received a $1400 stimulus check from the IRS?? The latest SSI SSDI VA Stimulus Checks!

When Will IRS Release EITC Refunds 2023-2024

The IRS initiates EITC refunds in January 2024 upon filing your tax return. For those claiming EITC or the additional child tax credit, expect potential delays until February due to mandatory credit verification.

Your eligible EITC amount hinges on income and family size, ranging from $632 to $7,830 for 2023. The IRS aims to release most EITC refunds by February 28, 2024, but some may take longer.

Remember, you have until April 15, 2024 (or October 15, 2024, with an extension) to file your 2023 tax return. Even if you e-file until November 2024, you can still get your EITC refund by year-end.

| file | Receiving date |

| EITC now…. | Jan 2024 |

| EITC or the additional child tax credit now….. | February 2024 |

| April 15, 2024 | before the end of the year 2024 |

| October 15, 2024 | before the end of the year 2024 |

| November 2024 | before the end of the year 2024 |

Eligibility of EITC Refunds

If you want to claim the EITC, you need to meet some criteria based on your income, credit amount, and investment income. Your income level also depends on whether you are single or married and how many children you have. The IRS has announced the EITC credit qualification for 2023-24 as follows:

| category | numbers | |||

| Children | 0 | 1 | 2 | 3 & More than 3 |

| Maximum AGI for Single | 17,640 USD | 46,560 USD | 52,918 USD | 56,838 USD |

| Maximum AGI for Marital | 24,210 USD | 53,120 USD | 59,478 USD | 63,698 USD |

| EITC limit | 600 USD | 3995 USD | 6,604 USD | 7,430 USD |

You can get the EITC from 600 USD to 7430 USD depending on the number of children you have and your maximum average gross income.

Your earned income and your adjusted gross income must be below the income limit for your filing status and number of children.

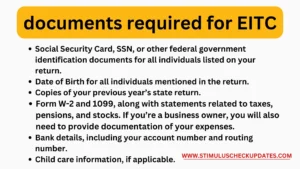

How to Claim EITC Refunds? Steps…

To claim the EITC, you need to file your income tax return with the IRS and provide some documents to prove your eligibility. The EITC is a refundable tax credit that reduces your tax liability and increases your refund. Here are the steps to claim the EITC:

Gather the documents you need, such as your Social Security card, SSN, or other federal government ID for yourself and anyone else on your return, your date of birth and the date of birth of anyone else on your return, copies of your state return from last year, forms W-2 and 1099, statements from pensions, stocks, or other sources of income, records of your business expenses if you have a business, your bank account and routing number, and information about your child care provider if you have one.

Fill out your income tax return using the IRS forms or software. You can use the IRS Free File program if you qualify or find a free tax preparation site near you. Make sure you check the box for the EITC on your return and attach Schedule EIC if you have qualifying children.

Submit your income tax return to the IRS by mail or electronically. You can track the status of your return and refund online or by phone. You should receive your EITC within three weeks of filing if there are no errors or issues with your return. If there are any problems, the IRS will send you a letter explaining what you need to do to resolve them and how they affect your refund amount.

also visit:

$2000 Stimulus Check update for Senior: expected date, amount, and Eligibility Criteria

What is the maximum refund amount for EITC Refunds?

- The IRS calculates taxes considering income, family size, and filing status.

- Refund processing times hinge on the chosen refund method and the claimed credit.

- EITC is a refundable tax that cuts down the owed tax by providing a credit exceeding the liability.

- The highest refund amount for EITC fluctuates based on the number of qualifying children and the taxpayer’s income level.

What is the income level for EITC Refunds?

The income level for EITC depends on the filing status and the number of qualifying children. For 2023, the income limit ranges from

- $21,430 for single filers with no children to

- $63,398 for married filers with three or more children.

- The taxpayer also cannot have more than $11,000 in investment income.

What is the filing status for EITC Refunds?

The filing status for EITC can be one of the following:

- married filing jointly,

- Head of household

- the qualifying surviving spouse,

- single, or

- married filing separately.

However, using the married filing separate status may disqualify the taxpayer from claiming the EITC.

you may also like:

EITC and ACTC Refunds in Accounts on Feb 27, 2024?

FAQs

[sp_easyaccordion id=”1986″]